Call me odd, but I find it fascinating to learn how different people research stocks.

We're all trying to find out the same thing: which stock will make us the most money?

But there are so many routes to getting to that conclusion. Whether we're talking about a prolific investor, occasional investor, short seller, day trader or any other buyer of stocks for that matter, everyone will have their method of determining which stocks will be a winning stock. For Muslims, the research process is that much more difficult, because it's necessary to have more checks in place.

For the Muslim investor that doesn't want to delve into the nitty gritty, but just wants to make some money, there are a few platforms that have already screened shariah compliant stocks. If you invest through those platforms, you will, of course, be paying a commission. More importantly, it effectively means you're endorsing their judgement call.

But what if you want to immerse yourself into the stock research process; what if you enjoy learning about the shares that interest you?

If you're starting out on your investment journey, read on...

Reliable sources of information

I use a combination of both paid and free information sources. But if I was forced to use just one, I'd pick the Hargreaves Lansdown (HL) website. On it, you'll find information such as share price charts, news, director deals, financial history and company information.

Hargreaves Lansdown is great for getting almost all the information you need in one place. But that doesn't mean all the information will be up to date by the minute.

For instance, suppose you wanted to find out how much insider trading was occurring, you could find that on HL, but that type of information isn't updated in real time.

By the way, if you've never taken insider trading into consideration, you may wish to. If a lot of the directors are selling shares, it could be a sign that they expect the share price to collapse (and possibly the company to collapse as well). For insider trading information, I've found the Shares Magazine website excellent. On it, you'll find real time insider trading transaction listings. In fact, you'll also find a section that has charts/ tables showing the top insider transactions. There's a good section where you can track any shares that were traded on the day. I tried it out on my own transactions to see how accurate it was. To my surprise, I was able to trace my own transactions even though it was a relatively small transaction.

No research is complete without updating yourself on company news. The best source of information, I have found, is industry specific publications. These publications only dedicate themselves to industry-specific news. The result is that news stories are reported quickly, with a fair amount of expert analysis. This information then takes a couple of days to reach the mainstream media. Such publications, however, are normally available to subscribers. But if you have enough interest in an industry, and think you could make money from it, it may be a worthwhile investment.

If you're not an avid reader but read to get essential information relevant for your trading activities, Google news alerts can be useful here. The service allows you to identify key words, and when those key words appear in the news section, you'll get an email alert straight to your inbox. Just a word of caution: choose your keywords carefully, otherwise you'll be inundated with emails! One of the stocks I was keeping an eye on using this method was Eventbrite. Every time a news story reported there was an event going on using the Eventbrite ticketing platform, I was getting an email about it. Sometimes it's better to use the ticker instead of the full name.

The website MarketWatch has a facility where you can see general stock market news, or news related to your stocks only (based on your watch list). The latter sounds great, but I've found it doesn't pick up stories unless they have reached mainstream media.

To find out information such as how much assets a company has, or how much debt it has taken on, the HL website will provide you with the financial information you need. This is possibly the least fun bit of the research, but crucial in determining if a stock is halal.

As for charts, I stick to Google Finance. Here, you'll be able to compare your chosen stock to a competitor's stock (although it's limited to a comparison of two stocks at the time of writing this article). You'll be able to see the chart over different timespans: 1 day, 5 days, 1 month, 6 months, 1 year, 5 years and "MAX". For most companies, selecting MAX tell you the share price on their stock market debut.

Paid information services can be better in some ways, but when people start out on their investment journey, they often like to test the water and see if investing in the stock market is right for them before committing to a paid service.

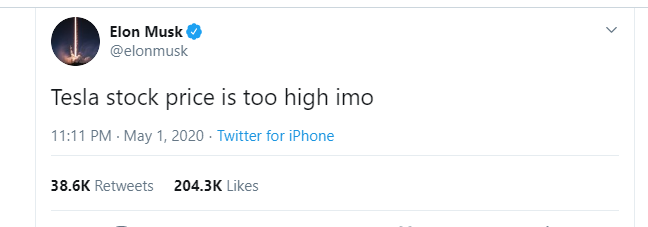

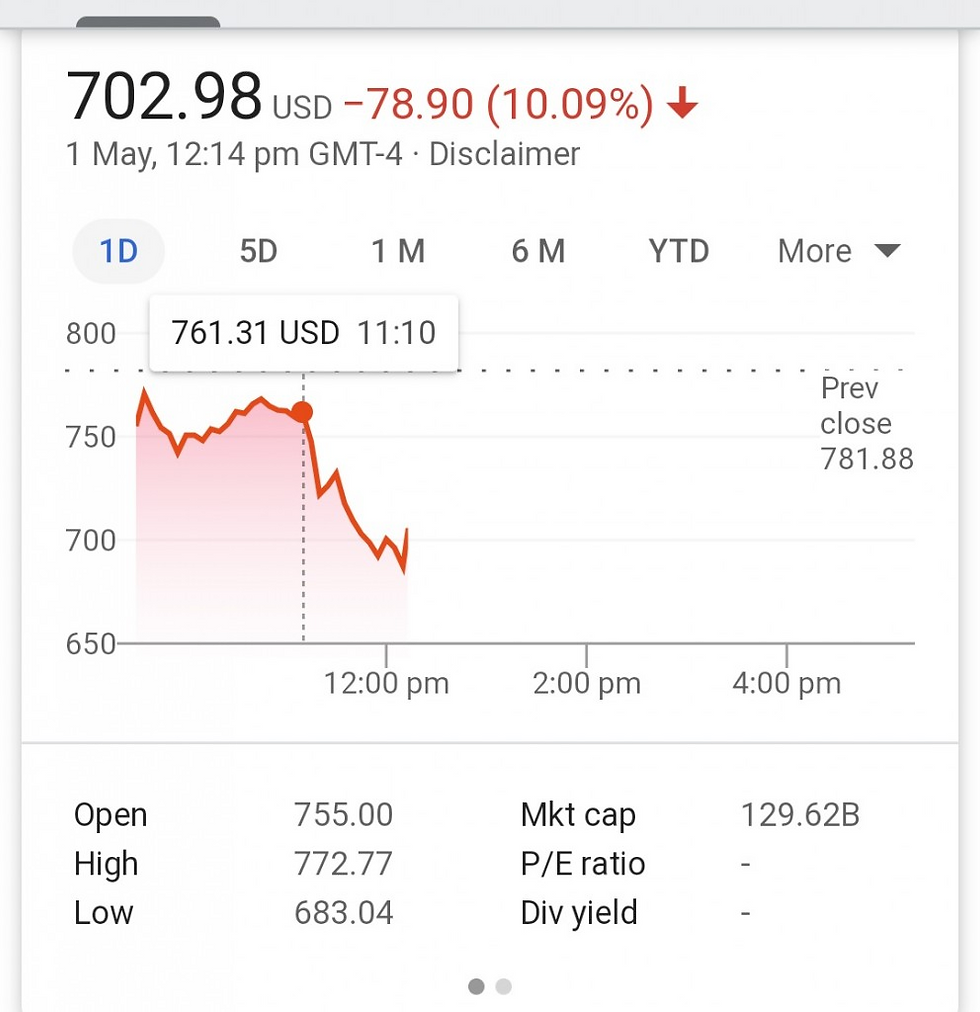

The main difference I've found with using paid services is that you can get company-specific information in one place very quickly. This greatly aids decision making when you need to make a quick judgement call. This comes in handy if a company loses value rapidly due to some one-off event or bad press coverage. Tesla, for instance, lost $14b in value in a matter of minutes after Elon Musk tweeted the value of Tesla was "too high". This started a massive sell off, and share prices began to slide very quickly. Anyone that bought stocks in Tesla* after the stock price tumbled following that tweet and sold even within a few hours would have made a handsome profit.

If you'd like to learn how to do in-depth research into a company, I suggest you read my article on Barrick Gold.

For now, that's enough to get started. Enjoy the journey and do plenty of research into your stocks before buying.

*Tesla is being used as an example only to show how quickly share prices can tumble. This is not a recommendation to buy Tesla shares. Indeed, Tesla currently has a debt: equity ratio of 112% at the time of writing this article. Scholars normally permit up to 33%.

Commenti