Whether you’re an investor or a trader, you’ll need to keep track of your transactions. This is because: 1) You’ll want to measure your stock performance (profit & loss, ROI growth, etc.)

2) You’ll have to pay zakat on your earnings from the stock market

3) You may have to pay tax on your stock market earnings

This is easier for investors because typically, they are involved in fewer transactions. A trader, meanwhile, may engage in a dozen or so transactions a day. Over the course of a year, keeping track of all this information can be a nightmare.

Fortunately, the trading platform you use can provide a statement. Naturally, some trading platforms will be better than others, but all should be able to help with providing you information on your trading activity.

The more traditional trading platforms will provide monthly statements, just like a bank. With the others, you’ll have to either request it or generate it through the platform.

My trading platform doesn’t allow me to generate statements – what should I do?

This is often the case with mobile app-only platforms. For whatever reason, it’s not possible to generate statements on most (if not all) app-only platforms. If record keeping is very important to you (and it should be), then I suggest you get in touch with their customer service department before you sign up to the platform to find out how they administer the trading statements.

As an example, let’s say you have an account with Freetrade. You’ll need to contact customer support and ask them for statements. There’s no phone support, so you’ll have to do this via the app. This is fairly straightforward but it will take a few days for you to receive the statement. Here are the steps you’ll need to follow.

1) Once the app is open, tap the ‘portfolio’ option in the bottom left of the screen. This will take you to your portfolio.

2) Once in the portfolio section, click the top right option, which takes you to your account

The image below shows the two options you'd need to tap (I've put a red square for quick visual reference):

3) Scroll down until you can see ‘chat to us’. Click it

The image below shows the option you'd need to tap (I've put a red square for quick visual reference):

4) You’ll be connected to an advisor if you do it during office hours. You simply need to ask

for your trading statement for whatever date range is important for you.

My trading platform does allow me to generate statements – but I don’t know how to do it

I’ll use eToro as an example here, who allow users to generate a statement (but isn’t exactly user friendly). Still, once you do it a few times, it’ll be a piece of cake.

Here are the steps you need to follow

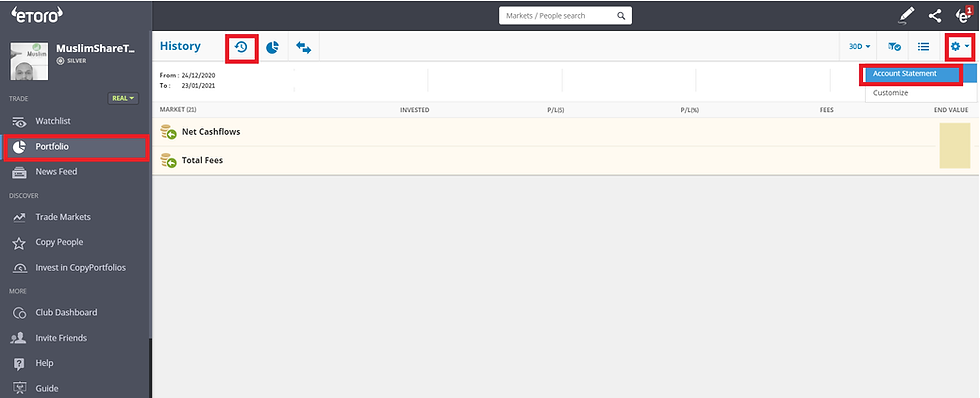

1. Go to your portfolio (must be in real account – not the virtual account)

2. Click on the history button (clock icon – top left side of screen)

3. Click on the setting button (cog icon – top right of screen)

4. Click on drop down menu and then "Account Statement"

The image below shows the option you'd need to tap (I've put a red square for quick visual reference):

5. Set the date range you need and press the tick

6. Click whether to download as PDF or Excel

There are so many trading platforms out there that it wouldn’t be feasible for me to show how to generate a statement for every platform. But the steps will be somewhat similar: Go to your account settings, set the date range you want the statement for, then generate a statement.

I’ve obtained a statement, but the data is not manageable

As you’ll be dealing with numbers, MS Excel (or similar) is the type of programme you should be using. Even if you don’t consider yourself an expert on Excel, don’t worry- you’ll only need to use the basic functions. But once you have all the data set out correctly, you’ll be able to work out your zakat and more.

Some platforms, like eToro, provide the statements in multiple file formats – including MS Excel. Others, like Freetrade, only provide a PDF statement.

If you are only able to generate a PDF, there are ways to make the data manageable. The process is slightly longer, but the end result will be the same, iA.

Here are the steps to convert your PDF account statement to an excel version.

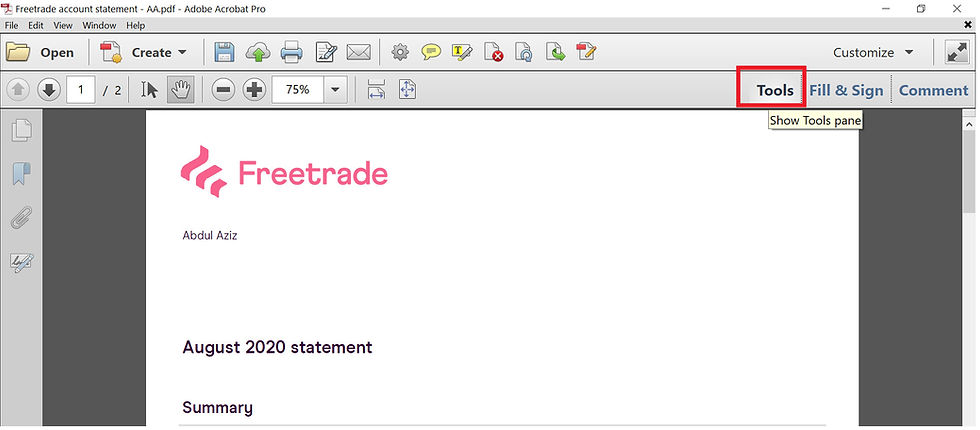

1. Download your PDF statement

2. Open your PDF statement in Acrobat reader

3. Make sure you can see the tool options. If you can’t see the options then press the "Tools"

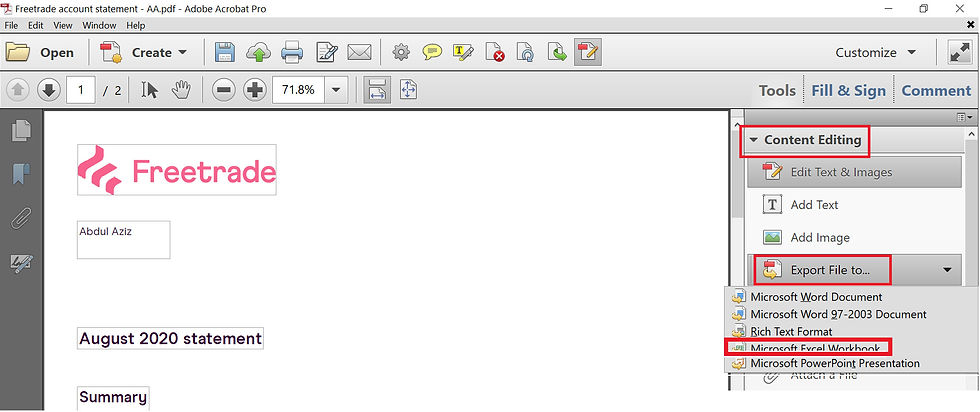

4. Click on "Content Editing"

5. Click on "Export File to..."

6. Click "Microsoft Excel Workbook"

The image below shows the two options you'd need to tap (I've put a red square for quick visual reference):

I’m an absolute technophobe – what should I do?

If you’re a technophobe, you’re probably an investor and not a trader (trading necessitates using technology very often). This makes record keeping easier because you’ll probably only have a handful of long-term stocks, and you’ll receive some sort of statement every time you receive a dividend either quarterly, bi-annually or yearly (depending the company’s dividend policy).

If this is the case, and you definitely don’t want to use a spreadsheet, you can work out your zakat and other liabilities by using good old pen and paper. Programmes like MS Excel are useful – necessary even, when there is a large amount of data to work through, but unneccesary for small amounts of data. .

I hope the tips in this article are helpful to you iA. Record keeping is one of those boring tasks that no one wants to do but everyone has to do. The sooner we get round to sorting out our records, the less stressful it will be later on when we need to use the records for, say, zakat calculations.

This article is actually one of the required readings for my free 30 Day Trading Programme. If you'd like more tips and advice, do consider joining the programme.

Comments